| Organizer Advantage HowTo/Help | Designer HowTo/Help |

Designer Help > Build Database Simple > Invoice Solution, Define, Calculate Tax and Total Price

How can I define the tax rate and implement it in a simple invoice solution to calculate the total price?

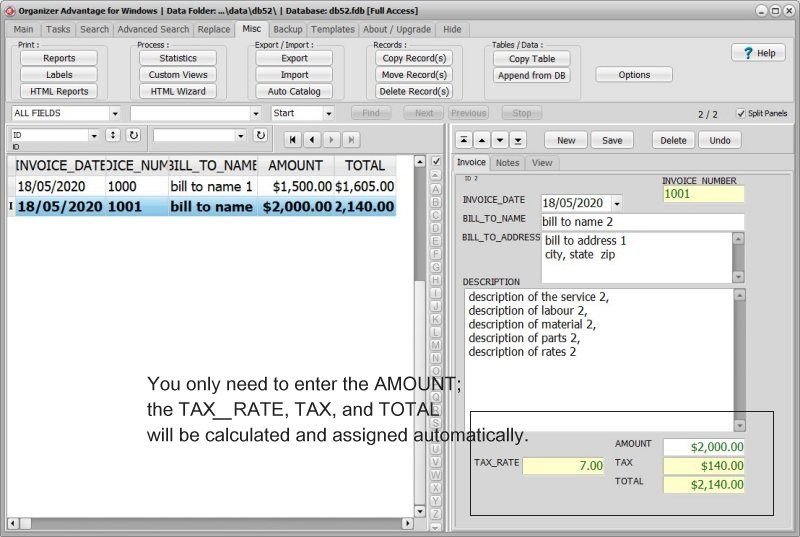

Simple Invoice Manager Sample

The simple invoice solution streamlines the creation and management of invoices, allowing users to easily enter key information like item details, costs, and taxes.

Users can define their tax rate to comply with local regulations, making it flexible for various business types. Once set, the tax rate is automatically applied to items on the invoice. For instance, if a product costs $100 and the tax rate is 10%, the software calculates the tax as $10, minimizing manual calculations and errors.

The total cost of the invoice is simply the item cost plus the tax. In this case, the total would be $110 ($100 item cost + $10 tax), clearly displayed for both the seller and buyer.

In summary, this invoice solution reduces administrative burdens by automating data input and calculations, allowing businesses to focus on their core activities while ensuring accuracy and compliance with tax regulations.

We provide a step-by-step explanation for data setup. You can either design

your solution or download, install, and review ready-to-use solutions.

- Invoice Organizer Advantage, Simple

- Invoice Organizer Advantage, Business

Invoice Table

We enter data about invoices into the Invoice table. The structure of this table is as follows:

ID:Integer:

INVOICE_DATE:Date:

INVOICE_NUMBER:Text:20

BILL_TO_NAME:Text:60

BILL_TO_ADDRESS:Memo:

DESCRIPTION:Memo:

AMOUNT:Numeric:

TAX_RATE:Numeric:

TAX:Numeric:

TOTAL:Numeric:

NOTES:Memo:

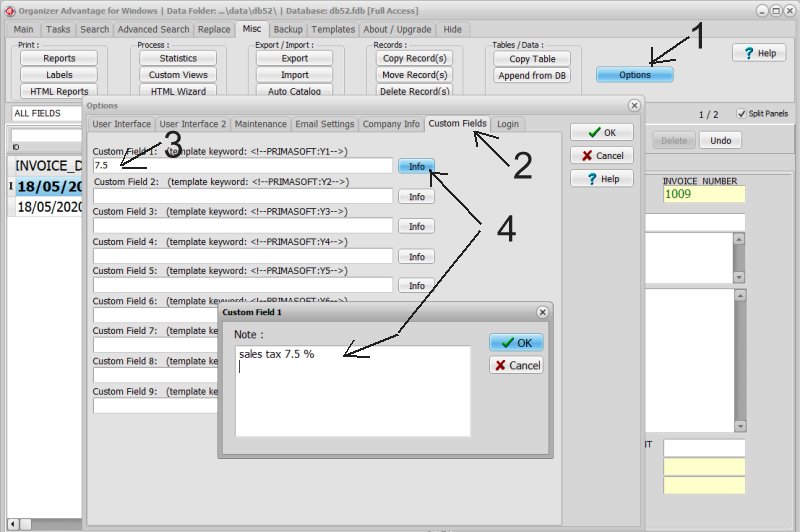

Define Sale Tax

- Launch the Organizer and select the Invoice table.

- Open the Options window (1) and click on Custom Fields (2).

- Enter the sales tax value (3). You can also add a note about this entry if desired (4).

- In the Designer, you can reference the "Custom 1 Field" using the format "@:NY1".

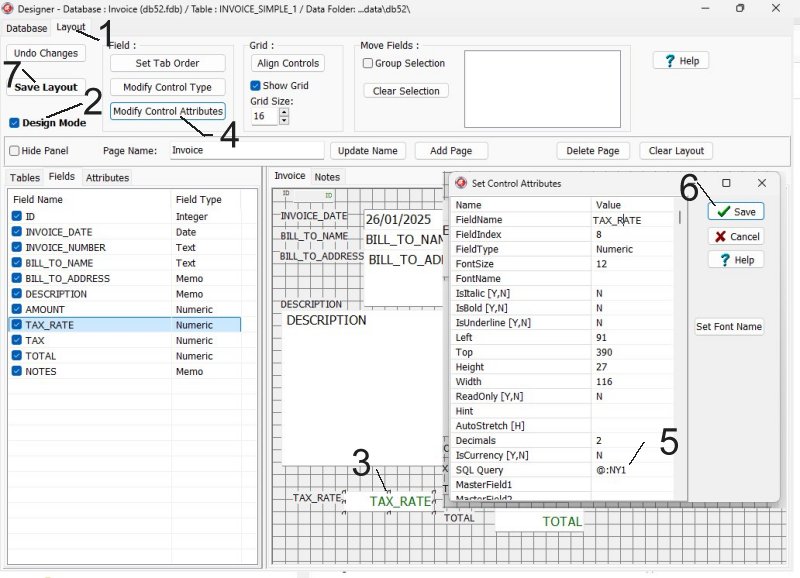

How can I link TAX RATE with the sales tax defined in the Options window?

- Start the Designer and select the Invoice table.

- Open the Layout page (1) and activate Design Mode (2).

- Click on the TAX_RATE box (3) to select it, then click on Modify Control Attributes (4) to display the Set Control Attributes options.

- Click on SQL Query (5) and enter "@:NY1".

- To save your definitions, click Save (6), and Save Layout (7).

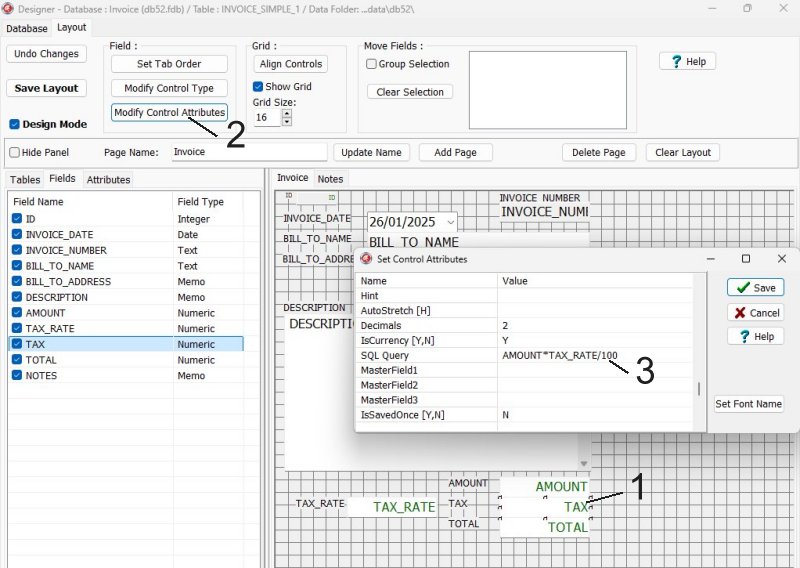

How can I automatically calculate the tax amount based on the item price?

- Start the Designer and select the Invoice table.

- Open the Layout page and activate Design Mode.

- Click on the TAX box (1) to select it, then click on Modify Control Attributes (2) to display the Set Control Attributes options.

- Click on SQL Query (3) and enter "AMOUNT*TAX_RATE/100".

- To save your definitions, click Save and Save Layout.

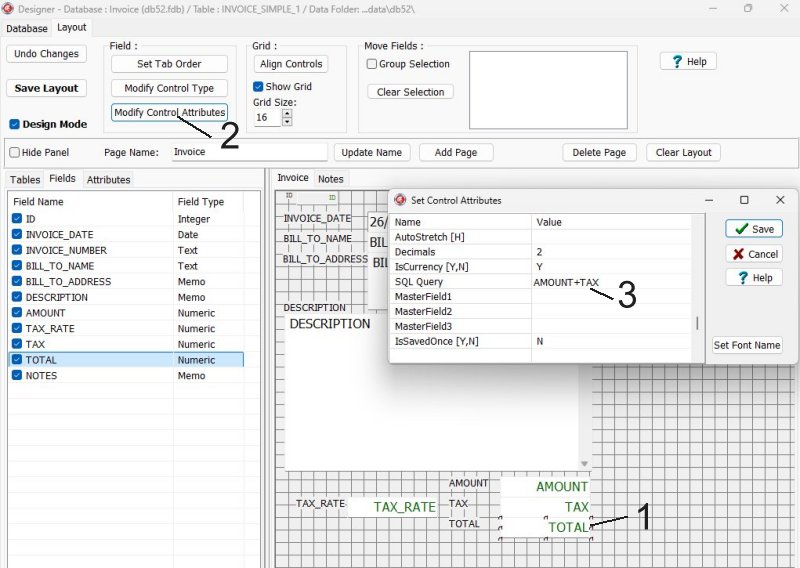

How can I automatically calculate the total cost based on item price and tax?

- Start the Designer and select the Invoice table.

- Open the Layout page and activate Design Mode.

- Click on the TOTAL box (1) to select it, then click on Modify Control Attributes (2) to display the Set Control Attributes options.

- Click on SQL Query (3) and enter "AMOUNT+TAX".

- To save your definitions, click Save and Save Layout.

Organizer Advantage, Simple Database Solutions for Windows PC

Organizer Advantage, Business Database Solutions for Windows PC

Copyright © 2025 · All Rights Reserved · PrimaSoft PC